TERMS OF USE FOR EASY DRIVE FINANCING WEBSITE

Understanding Your Credit Score and Its Impact on Car Financing

Introduction:

Your credit score plays a significant role in car financing. Here’s what you need to know about credit scores and how they impact your car loan.

What is a Credit Score?

Definition: A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850.

Factors: It’s based on factors like payment history, credit utilization, length of credit history, and types of credit.

Impact on Car Financing:

Interest Rates: A higher credit score can qualify you for lower interest rates, saving you money over the life of the loan.

Loan Approval: Lenders are more likely to approve your loan application if you have a good credit score.

Loan Terms: Better credit scores can also lead to more favorable loan terms, such as longer repayment periods or lower down payments.

Improving Your Credit Score:

Pay On Time: Ensure you make all your payments on time to maintain a good payment history.

Reduce Debt: Keep your credit card balances low and pay off any outstanding debts.

Check Your Report: Regularly check your credit report for any errors and dispute them if necessary.

Conclusion:

Understanding your credit score and its impact on car financing can help you make better financial decisions. At Easy Drive Financing, we work with customers of all credit backgrounds to find the best financing options. Contact us today to learn more.

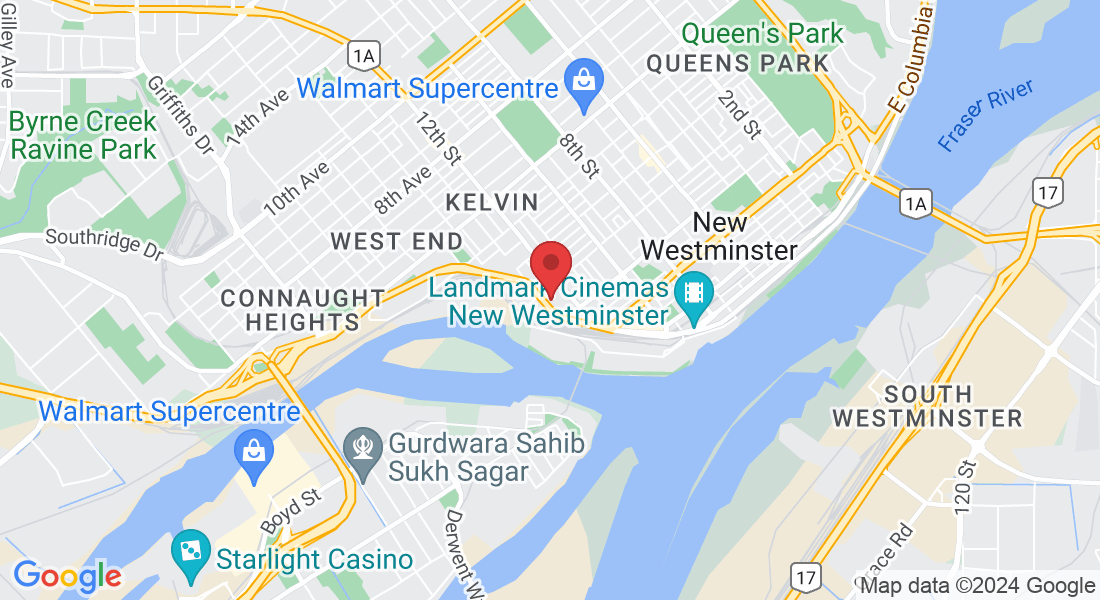

Get In Touch

Address: 235 Stewardson Way, New Westminster, BC V3M 2A4

Email: [email protected]

Hours of Operation:

Mon - Sat 9AM to 6PM

Sunday – Closed